The exemption under the Practice Directive will not apply to a company that has lodged a certificate relating to its status as an exempt private company with the Registrar pursuant to the CA 2016. Practice Directive 32017 Qualifying Criteria For Audit Exemption For Certain Categories Of Private Companies.

The Malaysian Companies Act 2016

Where beneficial interest of shares in the company are not held directly or indirectly by any corporation ie.

. Or c remain registered as a private company. As a starting point section 2672 of the Companies Act 2016 allows the Registrar of Companies to exempt any private company from the requirement to appoint an auditor for each financial year. B change its status into a private company.

However under section 2672 of the Companies Act 2016 the Registrar of Companies can exempt selected categories of private companies from having to appoint an. Notwithstanding this Section 2672 of the Companies Act 2016 empowers the Registrar of Companies to exempt any private company from auditing its financial statements. The Companies Act 2016 CA 2016 implemented in Malaysia on 31 January 2017 encapsulates the dynamic business environment in todays global corporate scenario as well as the consistent growth of the Malaysian economy.

1 A private company shall appoint an auditor for each financial year of the company. Members of the company or the Registrar can still require an audit. Ecovis Malaysia and its related entities in Malaysia trading as Ecovis Malaysia is a member of the global network known as Ecovis International.

Or c an unlimited company Where the company is a company limited by shares the members liability is limited to the amount unpaid on their shares and where the company is a company limited by guarantee a members liability is limited to the. Company Name CERTIFICATION OF STATUS. LODGEMENT OF CERTIFICATE RELATING TO AN EXEMPT PRIVATE COMPANY.

In this regard the following categories of private companies are exempted from the audit requirement. 1 A company limited by shares having not more than fifty shareholders may --a be registered as a private company. The new Companies Act 2016 CA 2016 implemented in Malaysia on 31 January 2017 encapsulates the dynamic business environment in todays global corporate scenario as well as the consistent growth of the Malaysian economy.

B a company limited by guarantee. A the company is and has at all relevant times been an exempt private company. The objective of the directive is to set out the qualifying criteria for private companies from having to appoint an auditor in a financial year audit exemption.

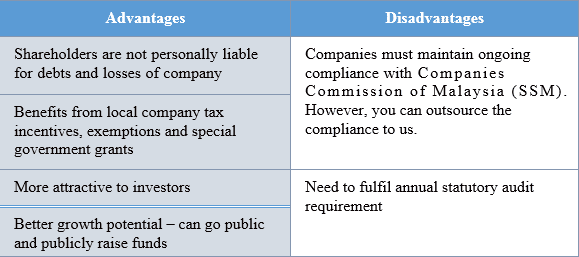

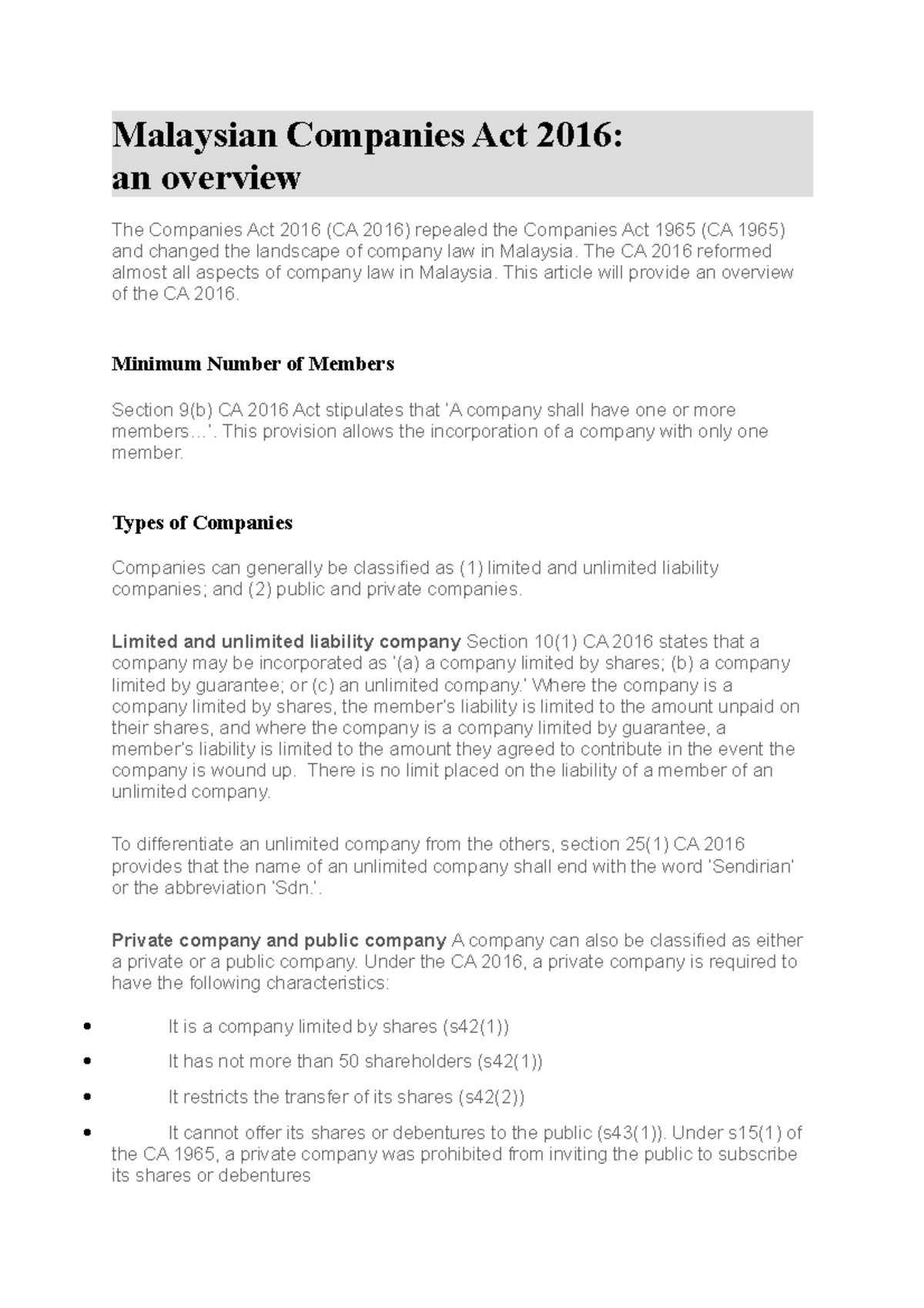

The Companies Act 2016 which came into operation on 31 January 2017 requires all companies to prepare and audit their financial statements before lodging it with the Companies Commission of Malaysia SSM. 2 Notwithstanding subsection 1 the Registrar shall have the power to exempt any private company from the requirement stated in that subsection according to the conditions as determined by the Registrar. Section 101 CA 2016 states that a company may be incorporated as a a company limited by shares.

B a duly audited financial statements and reports required under this Act made up to the. EXEMPT PRIVATE COMPANY IN MALAYSIA. The Companies Commission of Malaysia has issued.

PDF uploaded 132018 7. Any company that opts for audit exemption must submit its unaudited financial statements with the Registrar together with the required certificate in compliance with sections 258 and 259 of the Companies Act 2016 accompanied with a statement that the company is qualified for audit exemption and that the company receives no request from its shareholders that audit must be. Based on the CA 2016 exempt private company means a private company.

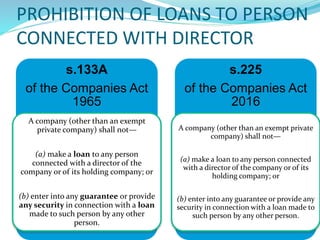

We hereby confirm that. On August 4 2017 the Companies Commission of Malaysia CCM has brought into force audit exemption for certain categories of private companies. PROHIBITION OF LOANS TO PERSON CONNECTED WITH DIRECTOR s4 of the Companies Act 1965 exempt private company means a private company in the shares of which no beneficial interest is held directly or indirectly by any corporation and which has not more than twenty members none of whom is a corporation and the same definition is stipulated in s2 of.

Ecovis International is a Swiss association. The new Act is at par with global standards. The Companies Act 2016 and Companies Regulations 2017 new Act have mostly come into force as of 31 January 2017.

Provisions Applicable to Certain Types of Companies. Which has not more than 20 members none of whom is a corporation. It ensures that the route for starting a business in Malaysia is more competitive which in turn will attract more.

The new Act aims to reduce the cost of doing business in Malaysia while increasing protection for stakeholders of a company. The new Act is at par with global standards. Each member firm is an independent legal entity in its own country and is only liable for its own acts or omissions not those of any other entity.

As part of this objective the incorporation process for Malaysian companies has been simplified allowing for significant. APPOINTMENT AUDITORS OF PRIVATE COMPANY. PDF uploaded 592017 6.

On 4 August 2017 the Companies Commission of Malaysia CCM issued a Practice Directive pursuant to Section 20C of the CCM Act 2001 and subsection 267 2 of the Companies Act 2016 CA 2016. 2 A private company shall restrict the transfer of its shares. Practice Directive 42018 Documents under Division 8 Part III of the Companies Act 2016 the Lodgement Requirements and Related Matters.

It ensures that the route for starting a business in Malaysia is more competitive which in turn will. Now the Companies Commission of Malaysia CCM has initiated a Public Consultation of Subsidiary Legislation under the Companies Act 2016. A company that is eligible for audit exemption shall be required to audit its accounts if it receives a notice in.

Malaysia Company Incorporation Faqs 3e Accounting

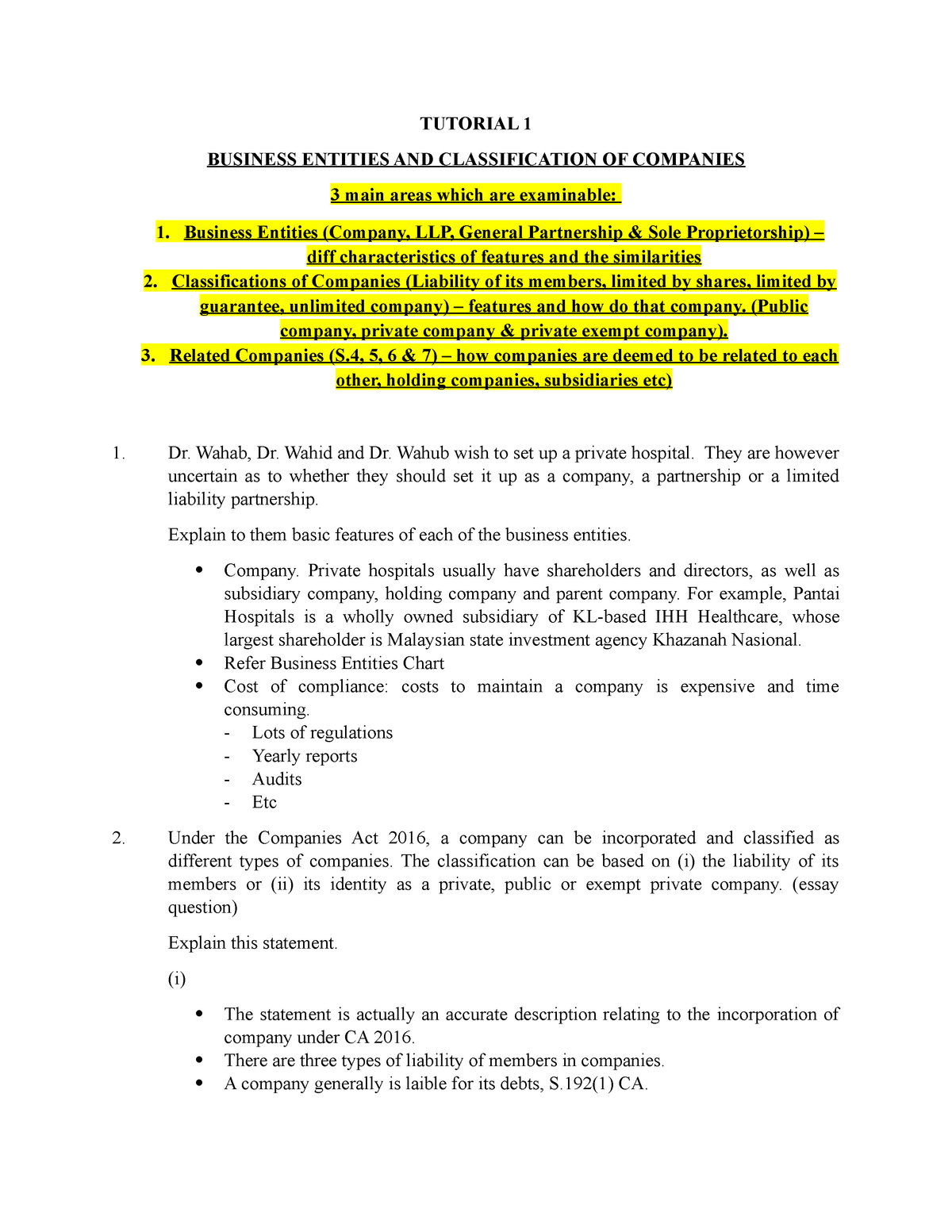

Tutorial 1 Tutorial 1 Business Entities And Classification Of Companies 3 Main Areas Which Are Studocu

Malaysian Companies Act 2016 The Ca 2016 Reformed Almost All Aspects Of Company Law In Malaysia Studocu

The Malaysian Companies Act 2016

Ccm Issues Practice Directive On Audit Exemptions For Private Companies Zico

The Malaysian Companies Act 2016

Ccm Issues Practice Directive On Audit Exemptions For Private Companies Zico

Exempt Private Company Epc And Its Directors Responsibilities Corporate Services In Malaysia Corporate Advisory Corporate Recovery Restructuring Company Secretary

Pdf Reasons Against Audit Exemption Among Sme Companies In Malaysia Semantic Scholar

The Malaysian Companies Act 2016

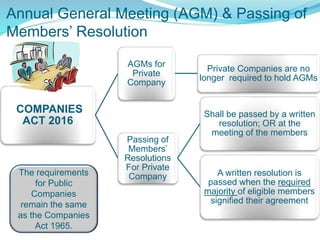

Corporate Law And The Incorporation Enforcement Date Of The Companies Act 2016 Will Be Effected On Studocu

Companies Commission Of Malaysia Faq Voting On Preference Shares And Single Member Public Company Meetings

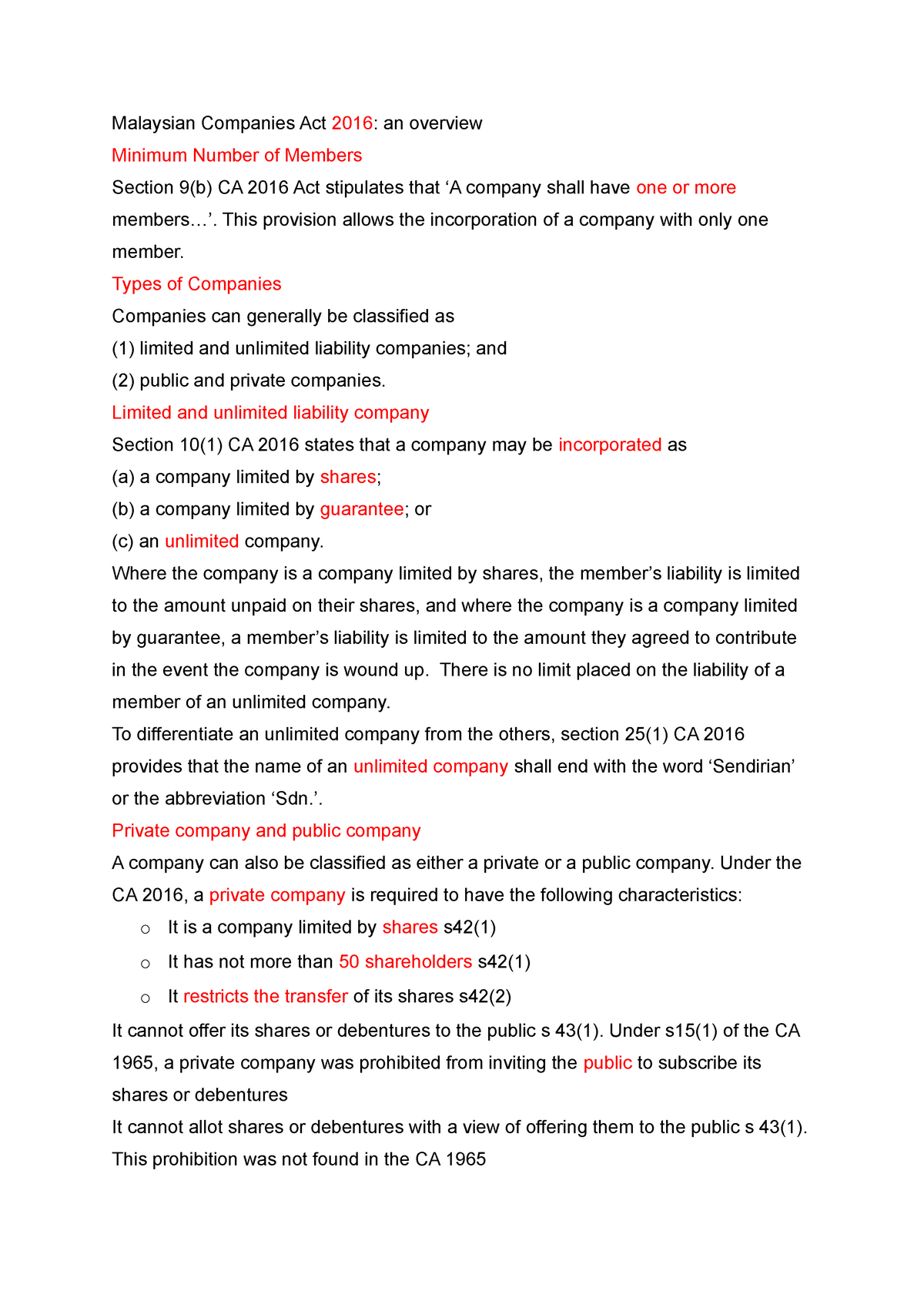

Ca 2016 Company Act Malaysian Companies Act 2016 An Overview Minimum Number Of Members Section Studocu

Exempt Private Company Epc And Its Directors Responsibilities Corporate Services In Malaysia Corporate Advisory Corporate Recovery Restructuring Company Secretary